Deep Dive: Community Development Financial Institutions Explained

What are CDFIs?

Community Development Financial Institutions (CDFIs) are specialized financial institutions certified by the U.S. Department of Treasury for doing work in low-income census tracks that provide financial products and services to people and businesses. These institutions have community development missions and a reputation for lending responsibly to low-income communities. CDFIs are uniquely mission-aligned as they aim to empower individuals and businesses in underserved areas by promoting economic development through job creation and investing in neighborhood revitalization, affordable housing, infrastructure improvements, and community facilities. In some cases, CDFIs are issue-focused and target specific impact objectives like poverty alleviation or solving food scarcity. In other cases, CDFIs target specific demographic groups, like ethnic minority groups or Native American populations, or serve specific target geographies. In all cases, CDFIs focus on community partnership and provide access to flexible, patient capital to individuals, organizations, projects, and businesses that aim to help communities grow and thrive.

What does the CDFI market look like?

According to the U.S. Department of Treasury, there are 1,487 CDFIs in the United States, managing a total of $452 billion. Both in terms of number of institutions (+40%) and AUM (+218%), the CDFI market has seen considerable growth from 2018-2023. These institutions provide funding and services to some of the most historically underserved populations in the country as 83% of CDFI clients are low income, and 61% are people of color.

In general, there are three main types of CDFIs: Loan Funds, Credit Unions, and Banks. While all three focus on promoting the goals outlined above, each one offers different flavors of products and services to accomplish their mission.

CDFI Loan Funds pool public and private capital together to provide financing and development services to businesses, organizations, and individuals. The four main types of loan funds are, microenterprise, small business, housing, and community service organizations.

CDFI Credit Unions are financial cooperatives that provide affordable credit and retail financial services to promote ownership of assets and savings.

CDFI Banks supply underserved communities with traditional retail banking services and provide capital to support community development through targeted lending and investing. Deposits at CDFI banks are insured by the FDIC.

What are the different sources of capital of CDFIs?

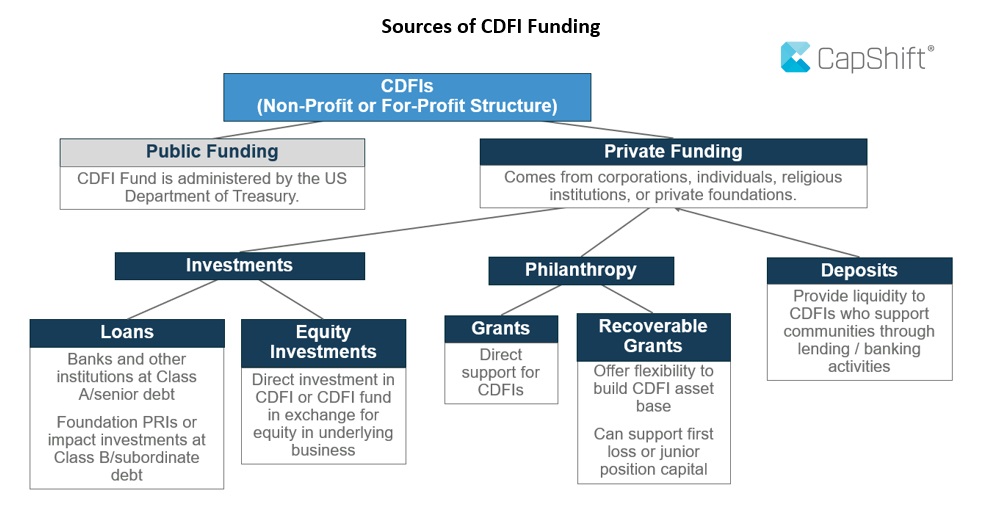

CDFIs receive funding from both the private and public sector. Public funding for CDFIs comes primarily from the U.S. CDFI Fund, which is administered by the U.S. Department of the Treasury, while private funding can come in the form of investments, philanthropy, or cash deposits.

While the funding sources for CDFIs are robust and diverse, many organizations still report that demand for their services outpaces the supply they can offer to the market. As recently as of Q3 2023, 60% of CDFIs reported not being able to fully meet increasing demand for their services. In these instances, nearly all organizations cited a lack of capital as a key reason for not meeting demand.

How do CDFIs invest for a more equitable future?

Whatever the source of funding, capital raised by CDFIs is deployed in a variety of ways to meet the needs of the communities they serve. Here’s a breakdown of some common strategies:

- Loans: A significant portion of CDFI capital goes towards loans for individuals and businesses. This can include:

- Small Business Loans: CDFIs specialize in providing loans to small businesses in underserved communities, which may struggle to get financing from traditional banks. In many cases these loans are securitized by the U.S. Small Business Administration (SBA).

- Microloans: These are smaller loans typically used for starting or growing a small business or for personal needs.

- Mortgage Loans: CDFIs can offer affordable mortgage options to help low- and moderate-income families purchase homes in their communities.

- Investments: Some CDFIs may also invest in businesses or real estate projects within their target communities. This can help create jobs and stimulate economic activity.

- Technical Assistance: In addition to providing capital, many CDFIs offer technical assistance programs to their clients. This can include financial literacy workshops, business plan development assistance, and loan counseling.

Using these strategies, CDFIs clearly support a wide array of impact areas that foster equitable communities. Thematically, the CDFI market has wide-ranging impact focus areas as their financing and investment activities help develop community infrastructure and affordable housing, provide accessible loans for home ownership, and increase access to educational opportunities. However, one impact area where CDFIs differentiate themselves is through investment and support for racial equity and social justice. As mentioned previously, more than half of CDFI clients are people of color making these institutions vital to serving, supporting, and empowering this specific underserved population. In recent years, CDFIs have innovated to take the work they do for their majority-minority client base further by creating powerful collaborative models that foster community empowerment within the BIPOC-community and work to support BIPOC-owned businesses equitably.

Why care about CDFIs in the context of client portfolios?

Investing in CDFIs can be a flexible and powerful tool for impact investors as they offer various portfolio benefits, a high degree of values alignment, and access to direct social impact.

CDFIs offer both equity and debt investment opportunities whose risks are historically more idiosyncratic than other traditional asset classes. This idiosyncratic risk can insulate CDFI investments from broader market fluctuations and make them attractive in the context of a broader portfolio allocation. According to the New York Fed, CDFIs have a cumulative net loan loss rate of ~1.5% over the last 20 years, which is on par with other FDIC insured institutions and demonstrates the relative strength of CDFI performance and repayment to investors. Additionally, CDFIs offer debt products in the form of notes with stable returns and varying tenors that allow investors to choose the liquidity profile of their investment.

It is important to note that not all CDFIs share the same risk/return profile or creditworthiness. As of May 2023, there were 22 CDFIs with publicly disclosed rated and unrated note programs in the market, totaling over $811 million, 11 rated by Standard & Poor with ratings ranging from A- to AA- according to a May 2023 paper published by LISC and Enterprise. These CDFIs tend to be larger in balance sheet and national in scale relative to smaller or more geographically or thematically concentrated CDFIs.

On the values alignment and impact side of the equation, CDFIs, due to their targeted approach, offer investors a chance to target specific communities or geographies of interest and specific issue areas. With this, CDFIs offer unique solutions to investors who have clear objectives related to certain impact themes or are interested in place-based investing. In terms of social impact, due to the populations they typically serve, CDFIs offer access to high impact investments that advance equity and DEI objectives. While serving underserved populations, CDFIs support communities that have traditionally been overlooked by larger financial institutions and provide a pathway to drive impact across a range of social issues.